Introduction and Background

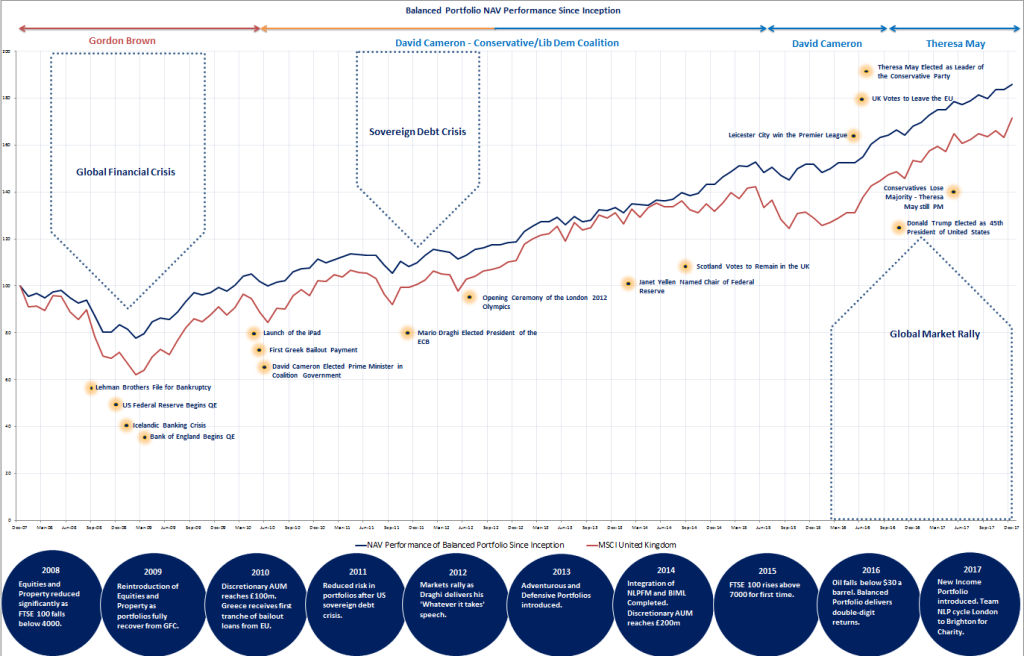

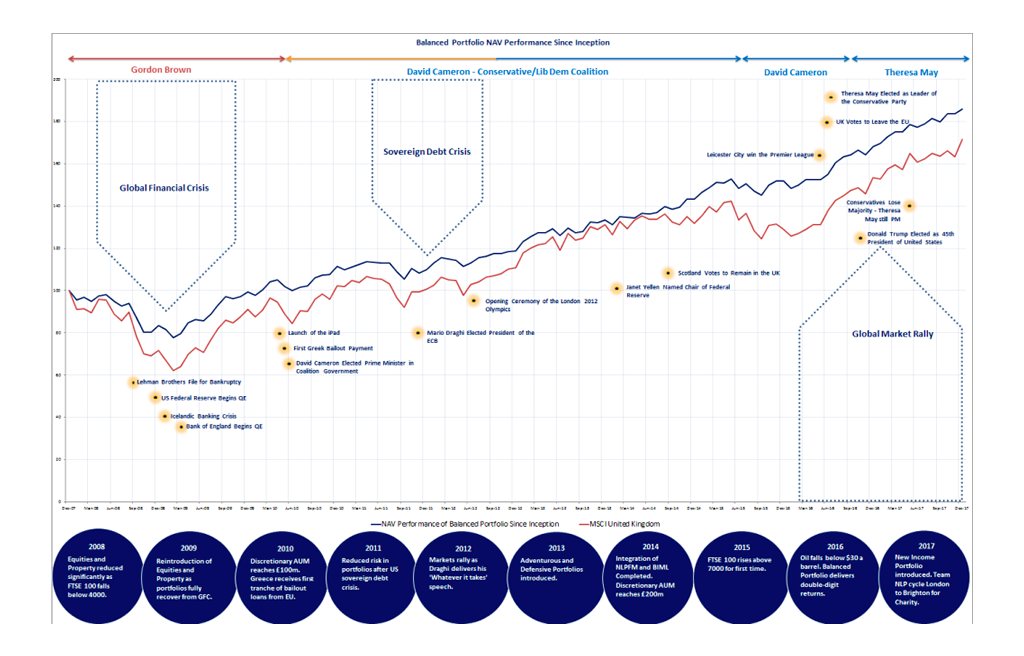

NLPFM are now celebrating the 10th anniversary of our Discretionary Management Service (DMS). In this article we will give you a short account of the milestone events of the past 10 years, our performance as well as our investment philosophy.

We started our DMS in 2008 in order to achieve better results for our clients: a model portfolio approach to manage portfolios in a conservative manner with quarterly rebalancing. This was the year of the worst market conditions in 79 years: the Global Financial Crisis when the stability of the markets was at risk.

On Monday 21 January 2008, global stock markets plummeted, as the FTSE 100 suffered its biggest ever one-day points fall and Asian markets declined by up to 15%. Over the month as a whole, the FTSE 100 Index dropped by almost 10%, its largest monthly fall since the recession of 2001.

The Credit Crisis that unfolded throughout 2008 led to huge declines in stock markets and financial instability that had not been experienced since the Great Depression of the 1930s. In July 2008, Fannie Mae and Freddie Mac, the two largest lenders in the US, and owners or guarantors of 5 trillion worth of home loans were bailed out by financial authorities. Worse was to follow on 15 September, as Wall Street bank Lehman Brothers filed for bankruptcy and another US bank, Merrill Lynch, was taken over by the Bank of America. On 11 October, the head of the International Monetary Fund (IMF) warned that the world financial system was teetering on the “brink of systemic meltdown”. Over the course of the year as a whole, the FTSE 100 fell by 31%.

In politics, Gordon Brown and George W Bush resided in 10 Downing Street and the White House respectively. In sport January 2008 saw Sir Alex Ferguson and Cristiano Ronaldo crowned Manager of the Month and Player of the Month respectively, as Manchester United led the Premier League. Novak Djokovic won the Australian Open, his first of 12 tennis Grand Slam titles, while Maria Sharapova won the women’s event.

Against this backdrop, at NLP Financial Management we launched our Discretionary Management Service. Initially we introduced our three core portfolios, our Cautious, Balanced and Progressive Models, and added two more portfolios, our Defensive and Adventurous Models, in January 2013. In early 2017 we launched a Balanced Income Model, to bring our total offering to six Model portfolios.

Since inception, almost ten years ago, our Cautious, Balanced and Progressive Model portfolios have achieved impressive gross returns of close to 82%, 86% and 97% respectively*. Over the same timeframe, the UK stock market as measured by the MSCI UK Index has increased by 72%, while the average Balanced Managed Fund, as measured by the AFI Balanced Index, has increased by 73%. On an annualised basis, we have achieved gross returns in the region of 8.6% from our Balanced Model portfolio and net returns after all charges in the region of 7.1% per annum.

* As at 31 December 2017

Managing Portfolios over a Turbulent Decade

In hindsight, 2008 was an extremely challenging time to manage investment portfolios, but as a result of our ability to react quickly to changing macro-economic conditions and due to our inherently conservative approach, our clients were happy and our relative performance was good, as we significantly reduced our equity exposure.

In March 2009 the markets bottomed out, down 40% from the previous highs when the major central banks reduced short term interest rates to zero and injected massive liquidity (monetary policy called Quantitative Easing). The Great Recession lasted from December 2007 until June 2009, after which stock markets started to recover while bond markets rallied too, driving interest rates to levels close to zero.

In 2011-12 the European sovereign debt crisis posed a new threat to the markets. The Greek debt write off in 2011 and the bail-out in 2012 calmed down the markets. Low interest rates and more political stability allowed equity markets and bond markets to rally. During this period, we reduced our exposure to European equities to zero.

At the end of 2016 the US Federal Reserve ended the ultra-low interest rate policy by raising rates for the first time in 8 years. The unexpected outcome from the Brexit referendum brought only short term volatility to the markets, while other political events (Presidential elections in the USA and France, parliamentary elections in the UK, Germany, Italy, Netherlands and France) had no impact on the markets. We reduced our property exposure during this time due to concerns over the impact of Brexit on commercial property in the UK.

While valuations are not currently considered cheap, low interest rates, the slow adjustment of monetary policy and the better financial structural framework provide downside protection for the markets. Lower volatility might prevail for longer. Our portfolios are positioned in line with our neutral house views and we recently increased exposure to Asia and Emerging Markets.

Low Volatility

Our investment portfolios are designed to target competitive returns with significantly lower investment risk than that employed by many in the industry. As such, the volatility of our portfolios is constantly reviewed to ensure that we meet our “peace of mind” and “safe pair of hands” guiding objectives.

Volatility measures the dispersion of returns for a portfolio or market index and can be calculated statistically by the “Standard Deviation”. A higher volatility indicates values can fluctuate over a wider range of values, with dramatic changes over a short time period in either direction. A lower volatility means that values do not fluctuate widely, but change at a steadier pace over time. Since inception, the volatility of our Cautious, Balanced and Progressive Models has been 4.7%, 5.3% and 5.9% respectively, compared to 10.3% and 6.3% for the MSCI UK Index and AFI Balanced Index. In other words, we have achieved our returns with approximately half the level of risk of the UK stock market and less risk than the average balanced fund.

Our Investment Approach

Our investment philosophy is based on preservation of capital whilst generating attractive returns, diversification across asset classes, geographical regions and investment houses, tactical asset allocation and rigorous fundamental analysis. The investment analysis team consists of 4 analysts and an Investment Committee of 10 members. All decisions are taken by the Investment Committee which is chaired by Lee Pittal, one of the Directors. The combined investment experience of our team is over 150 years. We meet on a weekly basis to review the asset allocation and underlying funds, and hold a quarterly in-depth Strategic Review Meeting, to establish our strategy and portfolio positioning for the forthcoming quarter.

As we are fully independent, each investment is selected on its own merits with no bias or obligation to any investment house or product provider. We undertake a combination of quantitative and qualitative analysis when selecting funds. Initially, we use a screening process to identify a number of potential funds in a given sector, looking at factors such as fund size, the tenure of the manager, investment style, volatility, performance and fees. We then meet the management of our favoured funds to understand their process and carry out more in-depth due diligence. This is the more qualitative aspect to the process and we will delve into areas such as the size of the investment team, the investment philosophy, stock selection and position sizing. We will also ask to see meeting notes from the managers of the companies they have met so we can understand whether they are doing what they claim.

This allows us to choose the funds we believe will best fulfil the role we are seeking within the portfolio. Funds are presented to the Investment Committee and a majority decision on approval will allow the fund to be added to our Models.

This process is carried out continuously to ensure that the funds we already have are performing the task we anticipated, whilst also identifying potential new opportunities. We will meet all existing funds at least once a year whilst regularly screening for new ideas in each sector.

The Future

Whilst our philosophy has not changed, our approach has evolved throughout the ten year period, and continues to evolve, as we adopt new processes and react to the changing trends in the industry and new investment opportunities.

We feel that our experience of managing portfolios during different stages of the macro-economic cycle, especially during the Credit Crisis of 2008, stands us in good stead for the future.

By adopting our “safe pair of hands” approach, along with a robust and extensive due diligence process, we are able to offer our clients an excellent investment proposition, designed to offer attractive returns and low volatility. As we celebrate our ten-year anniversary, we aim to build on our track record over the course of the next decade and beyond.

Click below to view full graphic